SOC i and SOC ii : Understanding the Key Differences

Information security and compliance are no longer just optional features for businesses. With the increasing reliance on cloud-hosted applications, SaaS companies need to take additional measures to inspire confidence and trust in their data security practices. One of the ways to do this is through SOC compliance, which serves as an industry-standard way to demonstrate your commitment to protecting data and building customer trust. But with different types of SOC reports available, how do you know which one is right for your organization? In this article, we’ll explore the differences between SOC 1 and SOC 2 and help you determine which is the better fit for your business.

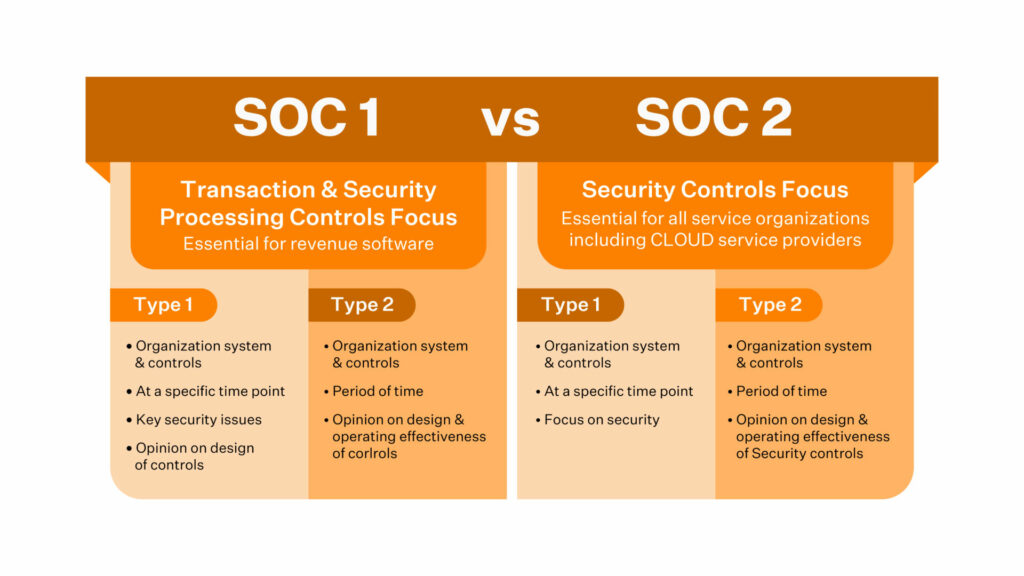

What is the Difference Between SOC 1 and SOC 2?

SOC 1 and SOC 2 reports differ primarily in their scope and focus. SOC 1 focuses on internal controls related to financial reporting. It assesses how well an organization handles its financial processes, providing assurance that the financial information is being managed securely. SOC 2, on the other hand, focuses on security and other trust service criteria, including availability, processing integrity, confidentiality, and privacy. It evaluates how well an organization protects customer data and ensures privacy and security in its operations. In essence, while SOC 1 reports are aimed at financial transparency and accuracy, SOC 2 reports emphasize safeguarding customer data and maintaining secure processes.

SOC 1 Report

A SOC 1 report is designed to evaluate the effectiveness of a company’s internal controls that impact financial reporting. It is particularly relevant for SaaS businesses or service organizations involved in financial services like billing or claims processing. The report assures clients that their financial data is being securely handled and that their financial reporting is compliant with industry standards. SOC 1 audits are conducted according to the Statement on Standards for Attestation Engagements (SSAE) 18 and AT-C Section 320. The report focuses on:

- Business Processes: Controls related to customer data processing.

- Information Technology Processes: Controls around the protection of customer financial data.

SOC 1 reports are intended for the customers of the SaaS provider and their auditors, especially when the client’s financial reporting is impacted by the provider’s services.

SOC 2 Report

A SOC 2 report evaluates an organization’s adherence to the Trust Services Criteria (TSC). These criteria focus on security, availability, processing integrity, confidentiality, and privacy. The SOC 2 audit is conducted by an independent auditor who assesses whether the business provides a secure, confidential, and available solution to its customers. The five Trust Services Criteria include:

- Security: Protection against unauthorized access and security breaches.

- Availability: Ensuring the system is available for operation and use as committed or agreed.

- Processing Integrity: Ensuring that processing is complete, valid, accurate, and timely.

- Confidentiality: Ensuring that confidential information is protected as per agreements or regulations.

- Privacy: Protection of personal information in line with privacy laws and regulations.

SOC 2 is relevant for businesses like cloud-hosted service providers, data centers, and SaaS vendors. It’s particularly useful for organizations handling sensitive customer data, as it proves their commitment to protecting that data.

Difference Between SOC 1 Type I and Type II Reports

Both SOC 1 and SOC 2 reports can be of Type I or Type II, and the difference lies in the duration of the audit:

- SOC 1 Type I: This report focuses on the design and implementation of controls as of a specific point in time.

- SOC 1 Type II: This report assesses the design, implementation, and operating effectiveness of controls over a defined period (typically 6–12 months).

Similarly, SOC 2 Type I and SOC 2 Type II have the same distinction, with Type I assessing controls at a single point in time and Type II evaluating ongoing effectiveness over a period.

SOC 1 vs SOC 2 – Which One Should You Choose?

Deciding between SOC 1 and SOC 2 depends on your business model and the type of services you provide:

- SOC 1: If your organization provides services that affect financial reporting or processing for your clients, such as financial software or billing services, SOC 1 compliance is essential.

- SOC 2: If your organization handles sensitive customer data and needs to demonstrate strong information security practices (such as a SaaS provider or data center), SOC 2 is the appropriate choice.

FAQs

1. What is the purpose of a SOC report?

SOC reports help organizations demonstrate their adherence to industry-standard practices for security, availability, and financial controls, providing assurance to customers and auditors that proper measures are in place.

2. Do I need both SOC 1 and SOC 2 reports?

It depends on your business operations. If you manage financial processes that impact your clients’ financial reporting, SOC 1 is necessary. If you handle sensitive customer data or provide cloud-based services, SOC 2 compliance may be more relevant.

3. How long does a SOC 2 audit take?

The duration of a SOC 2 audit varies based on the size and complexity of the organization, but it typically takes 3-6 months to complete, especially for a Type II audit that assesses a year of operational effectiveness.

4. What is the cost of SOC compliance?

The cost of SOC compliance can vary widely depending on the type of audit, the size of the organization, and the scope of the services being assessed. Generally, SOC 2 audits tend to be more expensive due to their broader scope.

In conclusion, SOC 1 and SOC 2 serve different purposes, and your choice depends on the type of services you offer and the specific needs of your clients. Whether you’re looking to ensure financial transparency or demonstrate strong data protection practices, understanding the key differences between these two SOC frameworks is crucial for making an informed decision.